Have you ever thought – “How do some people pick the right stocks and make big profits?”

Well, I used to wonder the same thing. And when I started learning about fundamental analysis, things finally began to make sense.

In this beginner-friendly guide, I’ll break it all down for you — in simple words, no technical jargon, and real thoughts like what I personally think about it.

What is Fundamental Analysis?

So let’s get this straight — fundamental analysis is like checking the health of a company before buying its stock.

Just like you wouldn’t buy a house without checking if it has water leakage, you shouldn’t buy a stock without checking the company’s “health.”

In simpler terms, it means analyzing a company’s:

- Financials (like revenue, profit, debt)

- Business model

- Future growth potential

- Industry and competitors

- Management quality

The goal? To figure out if the stock is undervalued or overvalued — and then make a smart buying decision.

Why Should You Even Care?

Here’s what I think:

If you’re a long-term investor or someone who wants to build wealth slowly but surely, fundamental analysis is your best friend.

Without it, you’re just gambling in the stock market. And trust me, you don’t want that.

Even Warren Buffett, the most successful investor in history, relies on it.

How I Think You Should Start as a Beginner

When I was a beginner, all those numbers, ratios, and charts looked scary.

But here’s what worked for me — and it’ll work for you too.

✅ Start with these 3 things:

- Pick a simple company you understand – like Zomato, DMart, or IRCTC.

- Read their latest annual report (available free on their website).

- Understand the business model – how they earn money, what expenses they have.

Don’t jump into ratios and balance sheets yet. First understand the story.

HDB Financial IPO 2025: Strong Fundamentals, Trusted Brand – Worth Applying? read also

Key Components of Fundamental Analysis

Here’s a handy table that explains everything you need to check:

| Component | What It Means | Beginner Tip |

| Revenue | Total money a company makes | Look for consistent growth |

| Net Profit | What’s left after expenses | Higher = better |

| Debt-to-Equity Ratio | How much loan the company has | < 1 is usually good |

| ROE (Return on Equity) | How well the company uses investor money | 15%+ is solid |

| EPS (Earnings per Share) | Profit per share | Growing EPS = positive |

| P/E Ratio | How expensive the stock is | Compare with peers |

Step-by-Step Guide to Do Fundamental Analysis

🧩 Step 1: Understand the Business

Go to the company’s official website or screener.in

Check:

- What the company does

- How it earns revenue

- Who are its customers

📊 Step 2: Check Financials

Use Moneycontrol or TickerTape to check:

- Profit & Loss statement

- Balance Sheet

- Cash Flow

📈 Step 3: Analyze Ratios

Start with these:

- P/E Ratio

- ROE

- Debt-to-Equity

- Operating Margin

🔍 Step 4: Check the Industry

- Is the industry growing?

- Who are the competitors?

- What’s the market share?

🧠 Step 5: Management & Vision

- Look at promoter holding

- Read the Chairman’s letter in the annual report

- Avoid companies with frequent management changes

Free Tools & Websites I Recommend

| Tool Name | Why I Use It | Link |

| Screener.in | Clean data & ratios | Visit Screener.in |

| TickerTape | Visual financial trends | Visit TickerTape |

| MoneyControl | News + Stock details | Visit Moneycontrol |

| Trendlyne | Great for Indian markets | Visit Trendlyne |

Top YouTube Channels to Learn From

If you’re a visual learner like me, watching YouTube videos really helps.

Here are my favorites:

- CA Rachana Ranade – YouTube Channel

- Invest Aaj For Kal – YouTube Channel

- SOIC (School of Intrinsic Compounding) – Deep analysis channel – YouTube Channel

Common Mistakes Beginners Make

Let me be honest — I’ve made most of these 😅

- ✅ Chasing hot tips instead of learning the company

- ✅ Ignoring debt levels

- ✅ Not reading annual reports

- ✅ Following influencers blindly

- ✅ Buying at highs without checking valuations

Take your time — even if it’s just one stock a month, make it count.

My Final Thoughts – Is It Worth Learning?

Absolutely YES.

Here’s how I see it:

If you can learn how to judge a company well, you don’t need to time the market. You just need to buy good businesses and stay invested.

It may feel boring at first compared to trading, but it works in the long run.

My Favourite Beginner-Friendly Stocks

If you’re ready to take your first step, here are 3 companies I personally feel good about (DYOR – Do Your Own Research):

- Tata Elxsi – Tech & design leader

- HDFC Life – Strong fundamentals

- IRCTC – Monopoly & government-backed

👉 Open a Free Demat Account with Zerodha – Recommended for beginners

✉️ Want More Guides Like This?

📩 Subscribe to my free newsletter:

“Money Mastery Weekly” – Get 1 actionable tip every week to grow your money.

Let me know in the comments:

Do you prefer technical analysis or fundamental analysis? And what stock are you currently researching?

❓ Frequently Asked Questions (FAQs) about Fundamental Analysis

1. What is the main goal of fundamental analysis?

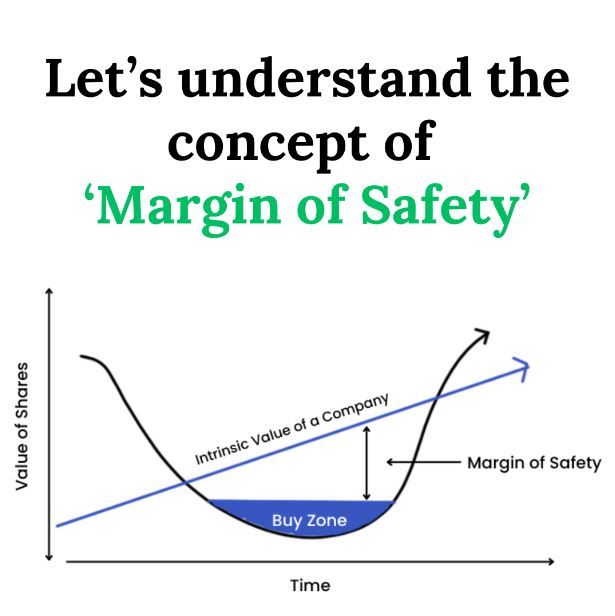

The primary goal is to determine the intrinsic value of a stock and see if it’s undervalued or overvalued in the current market. This helps investors make smarter long-term decisions.

2. Is fundamental analysis good for beginners?

Absolutely! In fact, if you’re someone who wants to build wealth slowly and safely, fundamental analysis is the best place to start. It helps you understand companies better before investing.

3. How is fundamental analysis different from technical analysis?

Fundamental analysis looks at the company’s financial health and growth potential.

Technical analysis looks at price patterns and charts for short-term trading.

If you’re planning for long-term investing, go with fundamental. For short-term trading, technical analysis works better.

4. Do I need a finance background to do fundamental analysis?

No, not at all. If you can read simple English and use free websites like Screener.in, you can easily get started. It’s more about logic and business understanding than complex math.

5. How much time does it take to analyze one stock?

As a beginner, it may take you 2-3 hours to analyze a company properly. But once you get used to it, you can do it in 30–45 minutes using a checklist.

6. What are some red flags to avoid in fundamental analysis?

High debt

Low promoter holding

Frequent management changes

Negative or declining profits

Regulatory issues or lawsuits

These are warning signs and should not be ignored.

7. Which websites or apps are best for beginners?

Some trusted tools include:

Screener.in

MoneyControl

Tickertape

TradingView for chart + news

8. Can I do fundamental analysis on mutual funds too?

Not exactly in the same way, but yes — you can check the fund manager’s track record, past performance, expense ratio, and portfolio allocation to make better decisions.

9. How often should I review a stock after buying?

Ideally, review it every quarter when the company releases results. If nothing major changes in the business, you can continue holding.