Intraday trading is all about timing. You might have the best stock in hand, but if you enter or exit at the wrong time, profits can vanish like smoke. One of the most crucial decisions every trader must make is:

Which time frame should I use for intraday trading?

In this blog, we’ll explore the most popular time frames (5-minute, 15-minute, and 1-hour), compare them, show real-world use cases, and help you pick the perfect one for your style. Whether you’re a beginner or an intermediate trader, this guide will help you trade more confidently and strategically.

🧠 Why Time Frame Selection Matters in Intraday Trading

Choosing the wrong time frame can either flood you with noise or make you miss opportunities. Every time frame tells a different story. Imagine reading one line from a novel vs. reading an entire paragraph—both give different perspectives.

Correct time frame = Better decision-making = Higher chance of success

🧩 1. Understanding Time Frames in Trading

A time frame in trading refers to the duration each candlestick or bar represents on your chart. For example:

- 1-minute chart: Each candle = 1 minute of price action

- 15-minute chart: Each candle = 15 minutes

- 1-hour chart: Each candle = 1 hour

These time frames help traders analyze market behavior, spot trends, and decide when to enter or exit trades.

🔄 How Different Time Frames Show Different Data

Let’s say a stock is moving upward in the 1-hour chart (long-term trend), but on the 5-min chart, it may be showing a dip (short-term pullback). That’s why traders often use multi-time frame analysis (explained later).

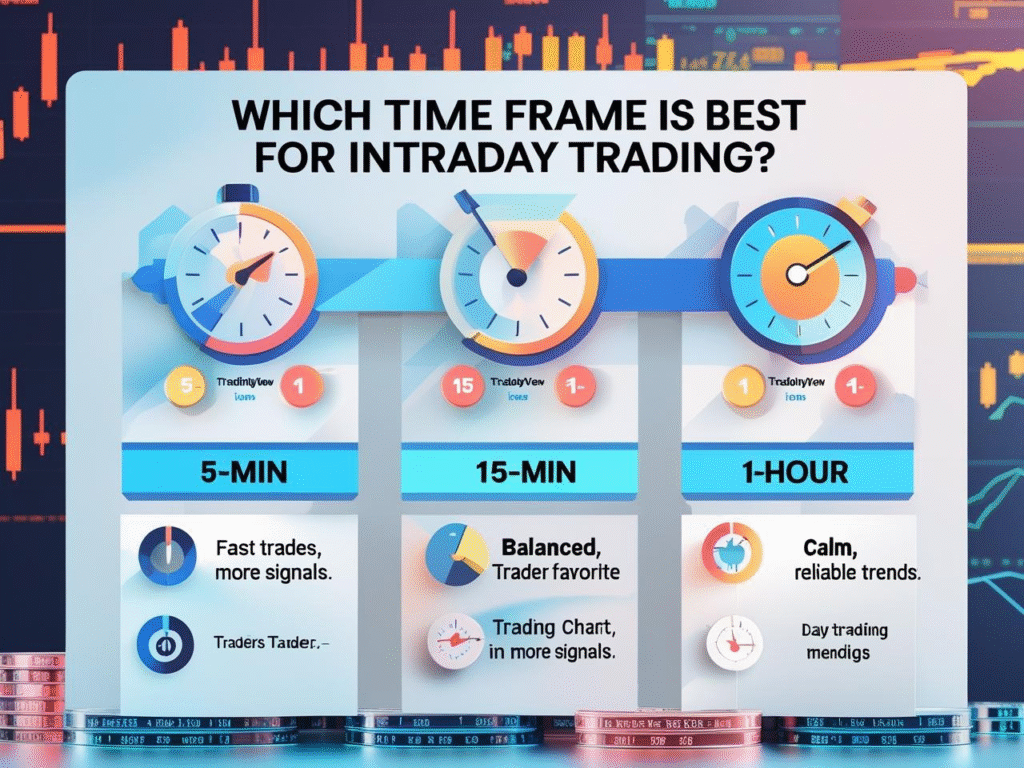

📅 2. Most Used Time Frames for Intraday Trading

| Time Frame | Use Case | Who Uses It? | Signals |

| 1-Min | Extreme scalping | Advanced scalpers | Very frequent |

| 5-Min | Fast trades | Active day traders | Moderate |

| 15-Min | Balance of speed and clarity | Most traders | Fewer but clearer |

| 30-Min | Fewer trades | Swing traders & calm traders | Strong signals |

| 1-Hour | Position intraday trades | Calm, patient traders | High-quality signals |

⏱️ 3. 5-Minute Time Frame: Fast & Furious

👍 Pros:

- Great for scalping (multiple small trades in a day)

- Provides many entry/exit opportunities

- Ideal for volatile stocks or indices like Bank Nifty, Nifty 50

👎 Cons:

- More noise, false signals possible

- Requires quick decisions and discipline

Example Setup:

- Use 5 EMA & 20 EMA crossover

- Confirm with RSI below 30 (buy) or above 70 (sell)

- Exit on next crossover or fixed points

Best For: Scalpers or full-time intraday traders

⏲️ 4. 15-Minute Time Frame: Trader’s Favorite

Why Most Day Traders Prefer It:

- Offers a balance between signal and noise

- Suitable for momentum trading strategies

- Less stressful than 5-min charts

Benefits:

- Enough time to analyze setup

- Good for trending markets

- Commonly used with RSI, MACD, and VWAP indicators

Example Strategy:

- VWAP + RSI for entry

- 1:2 risk-reward ratio

- Exit on candle close reversal

Pro Tip: Use 15-min chart with 1-min or 5-min chart for fine-tuning entries

🕐 5. 1-Hour Time Frame: Calm But Confident

Ideal for:

- Traders who can’t watch the screen all day

- Bigger intraday moves

- Confirming trends

Pros:

- Fewer signals, but stronger and more reliable

- Works well with swing-to-intraday strategies

- Helps avoid overtrading

Example: Buy breakout candles on hourly chart and use 15-min chart for entry

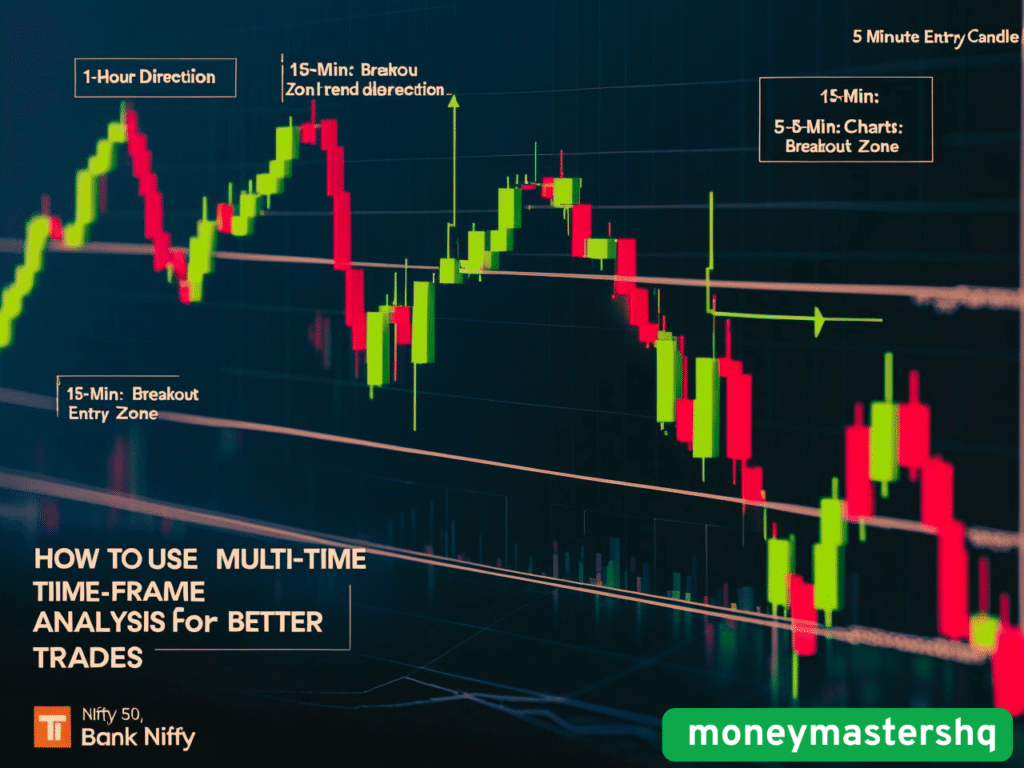

🔄 6. Multi-Time Frame Analysis (MTFA)

Don’t put all your trust in one chart. Smart traders use a combination of time frames for confirmation.

🔧 Example Setup:

- 1-Hour: Identify the trend

- 15-Min: Spot the breakout

- 5-Min: Entry and exit

Scenario:

If the 1-hour chart shows a bullish trend, and 15-min shows a consolidation breakout, enter on a 5-min confirmation candle.

📊 Bonus Chart Example:

Use TradingView (or any free tool like Chartink) to practice this MTFA approach.

🧪 7. Which Time Frame is Best for You?

| Your Profile | Best Time Frame | Reason |

| Beginner | 15-min | Balanced, less noise |

| Full-Time Trader | 5-min | High volume, quick profits |

| Office-Goer | 1-Hour | Less screen time needed |

| Risk-Averse | 30-min or 1-hour | Fewer trades, strong signals |

👉 Golden Rule: Your time frame must match your risk appetite, capital, and lifestyle.

❓ Frequently Asked Questions (FAQs)

Q1: Can I mix time frames in one strategy?

Yes! That’s called Multi-Time Frame Analysis (MTFA)—a proven way to get better signals.

Q2: Which time frame gives the most accurate signals?

No time frame is 100% accurate. Higher time frames offer more reliable trends, lower ones give faster entries.

Q3: Can I trade only on the 1-minute chart?

Only if you’re an expert scalper. It’s high-risk and requires fast execution.

Q4: What’s the golden rule in time frame selection?

Choose a time frame that aligns with your strategy, availability, and emotions.

Q5: Is 15-minute time frame best for beginners?

Yes. It’s perfect for learning, understanding price action, and practicing discipline.

🎥 YouTube Video Recommendation

🎬 “Best Time Frame for Intraday Trading Explained with Real Chart Examples”

👍 Learn by watching real setups and backtest examples

📚 Book Recommendations

| Book | Author | Why Read? | Buy Link |

| Intraday Trading for Beginners | Ankit Gala | Covers time frame setups in detail | [Amazon Link] |

| Technical Analysis of Financial Markets | John Murphy | Best book for understanding charts | [Amazon Link] |

| Come Into My Trading Room | Dr. Alexander Elder | Master psychology + time frame analysis | [Amazon Link] |

🛠️ Tools to Try (Free & Paid)

- TradingView – Free charting with custom time frames

- Chartink – Indian stock screeners

- StockEdge – Great for analysis and backtesting

Related Posts You May Love:

- Top 5 High-Growth Mutual Funds for SIP in 2025 to Safely Build ₹1 Crore Corpus

- Top 5 Mutual Fund Apps for Beginners (2025 Guide)

- How to Start Investing in the Indian Stock Market with Just ₹1000

- 5 Intraday Trading Strategies That Actually Work for Beginners with ₹10,000 Capital

🎯 Conclusion: Experiment → Backtest → Stick with What Works

There is no one-size-fits-all time frame. But if you:

- Test each time frame with your strategy

- Backtest it on past data

- Stick to the one that suits your mindset and goals

…you’ll become a more consistent and confident trader.

💬 What’s Next?

- 📥 Download Free PDF: Book

- 🔥 Tell us in the comments: Which time frame do YOU use for intraday trading and why?

- 👉 Visit: [moneymastershq.com] – Your one-stop guide for profitable trading

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.